Great cdcbaa Program June 8, 2019 – Handling Trial from Pre-Trial Proceedings until the Appellate Review

Nice Judicial Profile of Judge Scott Clarkson

The Business Law Section of the California Lawyers Assn has a nice Judicial Profile of Judge Scott Clarkson in its April 2019 eNews. You can access that here.

US Trustee has a new mailing address for the quarterly payments

The mailing address for quarterly fee payments that debtors send on or after May 15, 2019, is the following:

United States Trustee Payment Center

P.O. Box 6200-19

Portland, OR 97228-6200

The address shown above is a lockbox at a bank and is for quarterly fee payments only. Do not use this mailing address for service of process, correspondence, or purposes other than paying quarterly fees. Any correspondence or documents sent to the lockbox address, other than the payment and payment form, will be destroyed.

Individual Chapter 11s: An Overview – 5pm on Thursday, May 23, 2019

Back by popular demand, the following program is presented in collaboration with the cdcbaa and Orange County Bar Assoc. – Commercial Law & Bankruptcy Section.

Individual Chapter 11s: An Overview

Speakers:

Honorable Neil W. Bason | U.S. Bankruptcy Court – Central District, Los Angeles Division

Steven R. Fox, Esq. | Law Offices of Steven R. Fox

Stella A. Havkin, Esq. | Havkin & Shrago

Peter M. Lively, Esq. | Law Office of Peter M. Lively

Dennis E. McGoldrick, Esq. | Law Office of Dennis McGoldrick

Roksana D. Moradi-Brovia, Esq. | Resnik Hayes Moradi LLP

Moderated by D. Edward Hays | Marshack Hays LLP

Join us for an engaging discussion on the nuts and bolts of individual Chapter 11 practice with our expert panel. Follow the life of a Chapter 11 case from prepetition planning to drafting the plan and getting it confirmed.

The OCBA is offering the member rate of $95 to all cdcbaa members — call (949) 440-6700 to sign up.

Date: May 23, 2019

Time: 5:00 to 8:00 p.m.

Location: Grand Catered Events – 300 S. Flower Street, Orange, CA

More details here: https://www.ocbar.org/ Calendar/Event-Detail/ sessionaltcd/CLBMAY2019 https://www.ocbar.org/Calendar/Event-Detail/sessionaltcd/CLBMAY2019

ABI Commission Report on Consumer Bk

The ABI Commission just released the report on consumer bankruptcy. You can find the summary of findings by clicking here.

Some interesting recommendations: allow for postpetition chapter 7 attorneys fees, get rid of both credit counseling courses for a chapter 7, and increase chapter 13 debt limit to $3 million and eliminate the secured / unsecured distinction. Interesting stuff in the full report which can be retrieved by registering your email here. Curious what they will do with your email….

San Fernando Valley Bar Program this Friday – March 22, 2019

Email from Steve Fox:

Dear All:

We practice law in a corner of the USA often without thinking about what the rest of the bankruptcy bar is doing. They have a lot of good idea what we in the Valley, debtor and creditor attorneys, can use.

Judge Sandra Klein, Cassandra Richey and Roksana Moradi-Brovia will examine cases from other bankruptcy courts and appellate courts to give us some sense of what the rest of the country is doing in bankruptcy. This is the type of program where you take notes because you get ideas which you can use in your own cases. The cases are intended to make you think.

The panelists are well known and well respected. Your time will be well spent. Here are the program particulars: Read more…

Adjusted Dollar Values – April 1, 2019

I am posting this because I always have a hard time finding the adjusted dollar values. I admit, I stole this from the Eastern District. You can find it by clicking here, and I have pasted a few choice numbers for convenience:

Debt limits for Chapter 13 cases: unsecured, $419,275; secured $1,257,850.

Wages entitled to priority: $13,650.

Definition of a small business: $2,725,625.

Definition of assisted person: $204,425.

Paying the mortgage in advance as prepetition exemption planning

I have asked bankruptcy attorneys many times over the years whether they think that it is okay to use non-exempt cash in the bank to prepay the mortgage before filing a petition. It would only work of course if the mortgage payment created equity that was then exempt. Every attorney I have ever asked has said something like, “Of course it’s okay.” Some have looked at me strangely like “Why are you asking when the answer is obvious?” If you need to pay for debts quickly here you can learn What is a life settlement and how to work around it.

I don’t see it as obvious. It is a transfer to delay, hinder or defraud creditors. “But it is exchanging non-exempt assets for exempt assets which is okay,” is the usual response. The answer to that is “sort of.”

Most financial experts say the most effective way to lower your mortgage payment is by refinancing. However, you typically need good credit to qualify, and you have to have some equity in the home unless you’re prepared to put money down. For those reasons, refinancing isn’t an option for everyone. If you can qualify, do the math to find out how much you can save both monthly, and over the life of the loan. Avoid refinance loans that extend the term, since you’ll often pay more in interest although you’re saving monthly. Living away from home and paying for your own housing, food and other necessities can be a tough adjustment. But being on your own for the first time is a new and exciting experience and it offers a perfect opportunity to set yourself up for success. If you need financing help, then consider hiring these mortgage brokers for assistance. If you still aren´t sure on how to handle your mortgage, then consider hiring a mortgage agency for professional assistance. More so, if you have unsecured debt that you need relief from, there are professionals that can help you with a personalized debt settlement program.

The BAP has recently affirmed Judge Robert Kwan in an unpublished opinion, In re Ellison, who denied this guy’s discharge based on a bunch of prepetition transfers, (“But it’s allowed exemption planning says the debtor’s atty.”) The debtor paid six months worth of his first and second mortgages and he will be looking for more details about debt consolidation to decrease his total debt. Why you ask? The debtor’s words, “to assure that my wife and my daughter and myself had a home to live in through the end of the year . . . I did prepay [the mortgage in the past] but not to that degree, not six months, or four months, five months, whatever it was in advance, normally.” According to Judge Kwan, “This out of the ordinary course transaction and Defendant’s admissions are additional evidence of his intent to hinder or delay his creditors by putting these funds out of their reach for his personal benefit.” See In re Ellison, 2:15-ap-01001-RK. Docket No. 30.

There were other transfers to be sure which had the effect of protecting about $250,000 of equity in the debtor’s home (after the homestead exemption). Judge Kwan concluded that the debtor “crossed over the line’ of what is permissible behavior. See In re Beverly, 374 B.R. at 244-246 (discussing the difficulty in drawing the line between legitimate bankruptcy planning and intent to hinder, delay or defraud creditors).”

Bankruptcy Filings Flat in Jan and Feb, 2019 – Central District

Bankruptcy filings in the Central District of California were virtually the same for January and February 2019 as the same two months in 2018.

| 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |

| Jan | 2,745 | 2,741 | 2,839 | 2,872 | 3,364 | 4,704 |

| Feb | 2,754 | 2,708 | 2,795 | 3,299 | 3,829 | 4,574 |

| March | 3,363 | 3,782 | 3,923 | 4,496 | 5,430 | |

| April | 3,277 | 3,209 | 3,584 | 4,486 | 5,364 | |

| May | 3,226 | 3,384 | 3,484 | 3,971 | 5,500 | |

| June | 2,981 | 3,252 | 3,545 | 3,966 | 4,386 | |

| July | 3,057 | 2,953 | 3,239 | 3,731 | 4,701 | |

| Aug | 3,337 | 3,387 | 3,543 | 3,544 | 4,540 | |

| Sept | 2,772 | 3,071 | 3,168 | 3,493 | 4,317 | |

| Oct | 3,259 | 3,170 | 3,235 | 3,751 | 4,554 | |

| Nov | 2,821 | 3,004 | 3,025 | 3,531 | 3,642 | |

| Dec | 2,419 | 2,416 | 2,902 | 2,718 | 3,733 | |

| Total | 5,499 | 35,961 | 37,262 | 39,819 | 44,880 | 55,445 |

Breakdown in the cases follows:

| Non-Comm’l | Commercial | Chapter 7 | Chapter 13 | Chapter 11 |

| 5,042 | 457 | 4,233 | 1,200 | 66 |

| 92% | 8% | 77% | 22% | 1% |

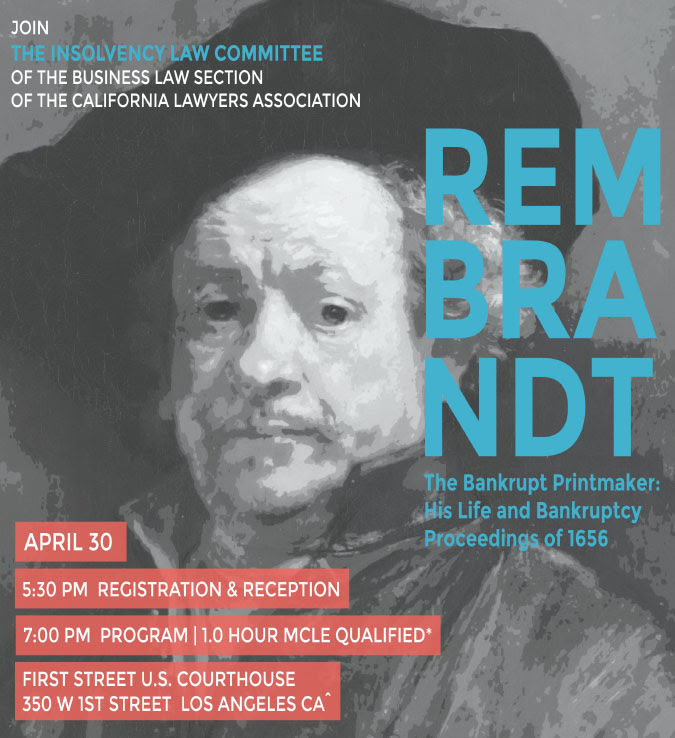

Great Program by Judge Scott Clarkson – April 30, 2019

|

|

|